As an insurance broker who’s spent years helping Ontario families protect their homes, I’ve seen firsthand how confusing—and frustrating—home insurance can be. Lately, the biggest question I get is: Why are my home insurance rates rising so fast, and what can I do about it? Let’s break down what’s really happening, why transparency is lacking, and how you can protect your best interests.

The Shocking Rise in Home Insurance Rates

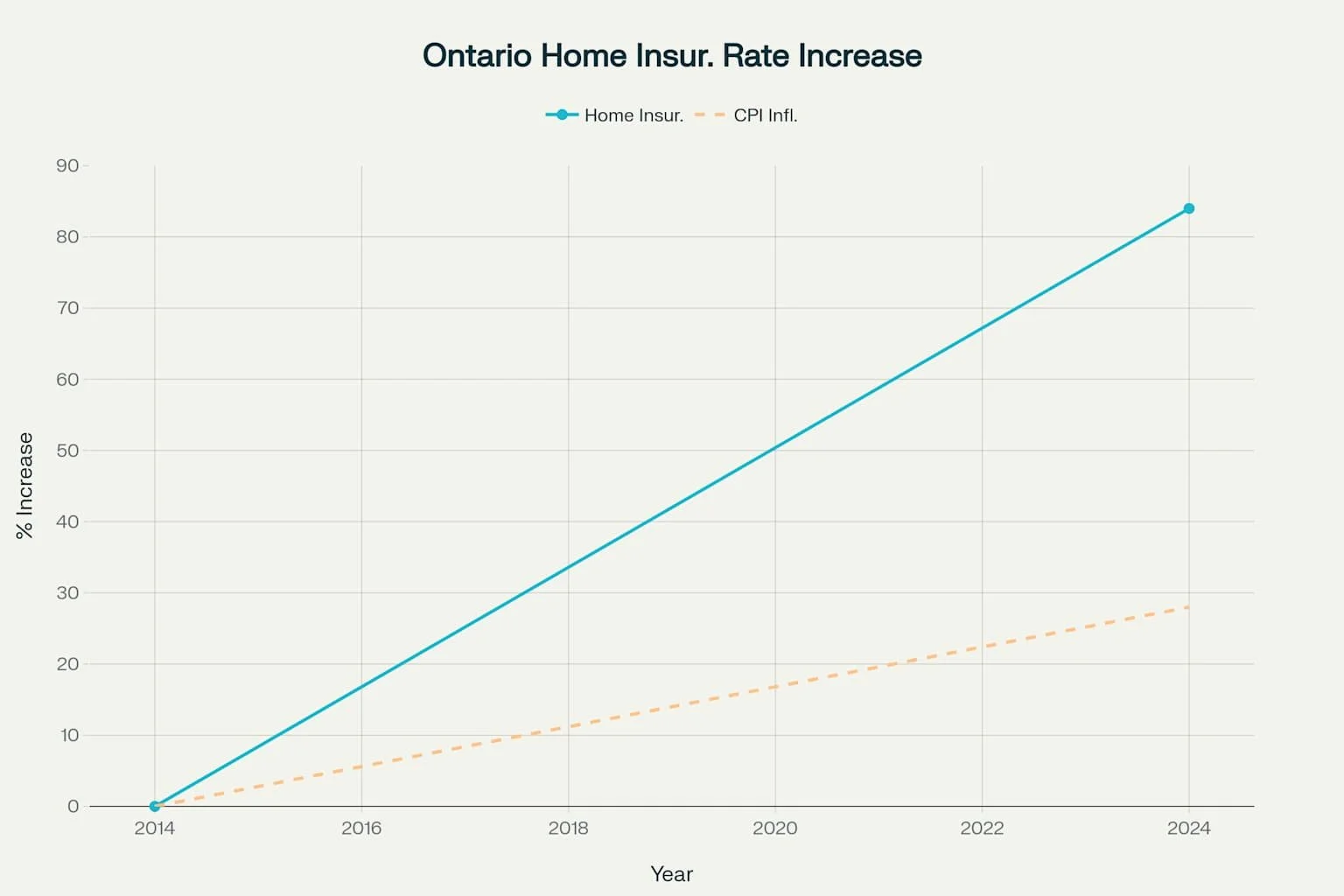

Between 2014 and 2024, Ontario home insurance rates soared by a staggering 84%. For context, the general cost of living (measured by CPI inflation) only rose 28% in the same period. That means your insurance bill likely grew three times faster than your grocery or utility costs.

Ontario home insurance rates rose 84% from 2014 to 2024, far outpacing CPI inflation (28%)

What’s Driving These Increases?

The main culprit is climate change. Extreme weather—floods, wildfires, windstorms—has become more frequent and severe, leading to more claims and higher payouts by insurers. This risk is passed on to you, the homeowner, in the form of higher premiums.

But that’s not the whole story. Other factors include:

Rising repair and construction costs due to inflation and supply chain issues.

Insurance company investments in sectors like fossil fuels, which ironically contribute to climate risks.

Lack of government backstops for high-risk properties, making some homes nearly uninsurable.

The Transparency Problem

Unlike auto insurance, where Ontario’s regulator (FSRAO) provides public data and analysis, home insurance rates are a “black box.” Consumers are left in the dark about why rates are rising, how insurers calculate risk, or what’s being done to address affordability.

Advocacy groups are now demanding that FSRAO investigate these trends and require insurers to be more open about their pricing and risk models. As a broker, I fully support this push for transparency. You deserve to know what’s driving your costs and what’s being done to protect your interests.

Honest Advice for Homeowners

Here’s what I recommend to every client:

Shop around: Not all insurers assess risk the same way. A broker can help you compare options and find discounts for home upgrades (like sump pumps or fire-resistant materials).

Increase your deductible: If you can afford a higher out-of-pocket cost in the event of a claim, your premiums may drop.

Ask about climate resilience: Some insurers offer discounts for making your home more resilient to extreme weather.

Stay informed: Push for more transparency from both your insurer and the regulator. The more you know, the better you can protect your wallet.

The Bottom Line

Ontario homeowners are facing a perfect storm: rising risks, higher costs, and a lack of clear information. As your broker, my job is to advocate for you - not the insurance companies. I urge regulators to shine a light on how rates are set and to hold insurers accountable for fair, transparent practices. In the meantime, don’t hesitate to reach out for honest, unbiased advice tailored to your needs.